Alright everybody, this is the part where thoughts become actions. As of yesterday, I have officially put the envelope system into use. Get ready for…

5. Use the envelope system for managing variable spending

That title sounds super boring now that I’m typing it a second time… Oh well. This is the key to us saving money, which is absolutely NOT BORING at all 🙂

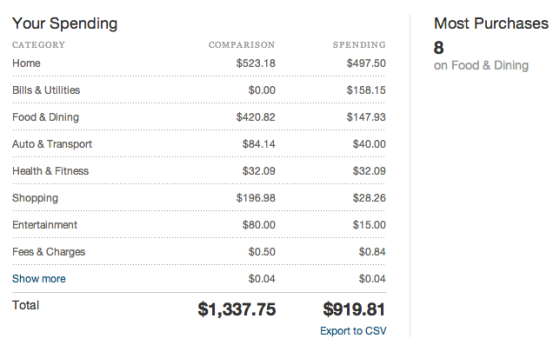

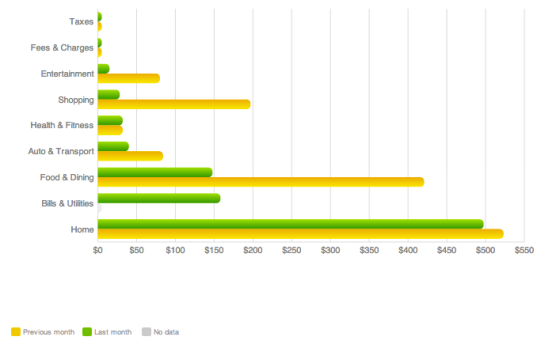

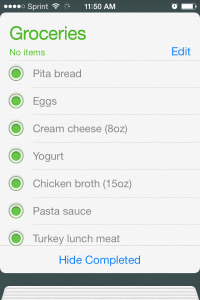

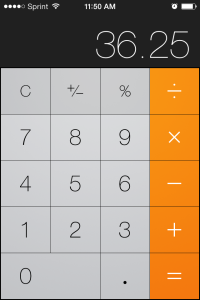

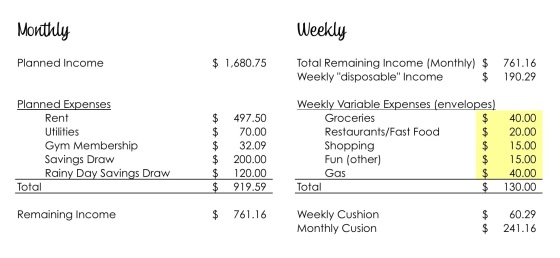

In my last post, I determined the following weekly budget for my variable expenses:

- Groceries = $40

- Gas = $40

- Dining = $20

- Fun (entertainment) = $15

- Shopping = $15

That totals $130 of variable spending each week (in addition to rent, utilities, etc.) and is a pretty significant reduction from my previous habits. If you have gone through the first 4 steps of this process with me, you’ve already determined your budget, and are ready to make practical use of the budget system.

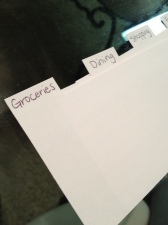

Even though this is the “envelope system,” envelopes are not actually required. The whole point of doing this is for you to stick to using cash for your purchases, so find a way for you to organize the money that makes sense for your life. One option is to get an accordion folder (usually referred to as a coupon organizer) and label the dividers accordingly.

After looking at a few versions of this organizer, I felt it was too bulky for the type of purse I tend to carry. I also envisioned myself grabbing my wallet and leaving all my cash behind. No bueno. Instead, I decided that I would get a wallet with a separate side pocket that was big enough to tackle the organization. I treated myself to a Merona wallet from Target (purchased with a gift card, and not my shopping budget) and used regular 3×5 index cards for separation.

Now, to refresh everyone’s memory, let’s go over the rules of using this system. In actuality, you can decide whatever rules you want for your budget. The ones I strongly recommend following are these:

1. Pick a day of the week to “refill” your envelopes – I selected Fridays after work. That’s the best day for me to get to the bank and organize. I also like starting at the weekend, because that’s when I tend to spend the most on Fun, Shopping, and Dining. I would rather spend first and “make it work” later in the week than get to the weekend and be sad that I can’t afford anything.

2. Once an envelope is empty, you CANNOT add to it! – This is pretty straightforward. This system does absolutely nothing if you go to the ATM every time you run out of money. You might as well stick to the debit card.

3. If you do use a debit card, subtract the amount from the appropriate envelope – If you need to make an online purchase or you forget your envelopes (don’t do that!), keep track of how much you spend and in what category. Remove that amount of cash and hold it back for next week.

Exceptions and special purchases

I know what you’re thinking, “$15 a week for shopping? Am I never allowed to buy clothes again?” The answer is no. First of all, you can definitely budget more for shopping. That is a personal preference. Second, I recommend saving the budget up over a few weeks. If I decide I’m going to buy a new jacket, I’ll research what I want, find a good deal, and save my shopping budget until I can afford it. If it’s $50, I can buy it in 4 weeks. This helps you save money because you have to prioritize. It reduces impulse spending, and it shows you how much you really want that item. Tip: Print out a little picture of what you’re saving for and stick it in the front of the envelope!

In general, you can decide what your rule is for saving money you don’t spend come week’s end. You can either leave it in the envelope and add the total amount for your budget (giving you a little boost for the coming week), or just refill enough so that you’re back up to the allotted budget amount (allowing you to save even more than you planned). I intend to let my budget “roll over” from week to week so I can splurge occasionally.

Stay tuned for tips on using the cash envelope system and please submit any of your own tips or questions in a comment below. Happy saving!